The Future of Steel: Investing in Titan Share Price

Steel, an essential component of modern infrastructure and construction, plays a pivotal role in driving economic growth and development worldwide. As investors seek opportunities in the steel industry, Titan Company Limited emerges as a promising investment option, offering exposure to the future of steel and its applications in various sectors. In this article, we’ll explore the potential of investing in Titan share price, analyzing key factors influencing its future trajectory. Meanwhile, it also help in emphasizing the importance of managing demat account how to open charges for maximizing investment returns.

Understanding Titan Company Limited:

Titan Company Limited, a subsidiary of the Tata Group, is a leading player in the Indian consumer goods industry. While not directly involved in the steel sector, Titan’s diversified product portfolio includes jewelry, watches, eyewear, and accessories, which utilize steel and other metals in their manufacturing processes. Titan’s strong brand presence, innovative designs, and customer-centric approach make it an attractive investment option for those looking to capitalize on the future of steel and its applications in the consumer goods segment.

Factors Influencing Titan Share Price:

Consumer Demand: Consumer demand for steel-intensive products, such as jewelry, watches, and accessories, directly impacts Titan’s revenue and profitability. As economic conditions improve and disposable incomes rise, consumer spending on discretionary items like jewelry tends to increase, driving demand for Titan’s products and potentially boosting its share price.

Supply Chain Dynamics:

Titan’s supply chain dynamics, including sourcing of raw materials like steel and other metals, logistics, and manufacturing processes, influence its cost structure and operational efficiency. Any disruptions or fluctuations in the steel market can impact Titan’s profitability and share price performance along with the knowledge about demat accounts how to open processes.

Innovation and Design:

Titan’s focus on innovation and design excellence sets it apart in the competitive consumer goods industry. Continuous product innovation, introduction of new designs, and adoption of advanced manufacturing techniques enhance Titan’s brand appeal and customer loyalty, potentially translating into higher sales volumes and share price appreciation.

Market Expansion:

Titan’s expansion into new markets, both domestic and international, presents growth opportunities for the company. As it taps into emerging markets and explores new distribution channels, investors may anticipate revenue growth and market share expansion, driving positive sentiment and Titan share price appreciation.

Managing Demat Account Charges for Enhanced Returns:

While evaluating the potential of investing in Titan share price, investors must also consider the impact of demat account charges on their investment returns. Managing demat account charges effectively, including minimizing account opening charges, negotiating favorable terms with depository participants (DPs), and optimizing transaction costs, can help investors maximize returns and enhance profitability over time along with knowing about demat account how to open process.

Conclusion:

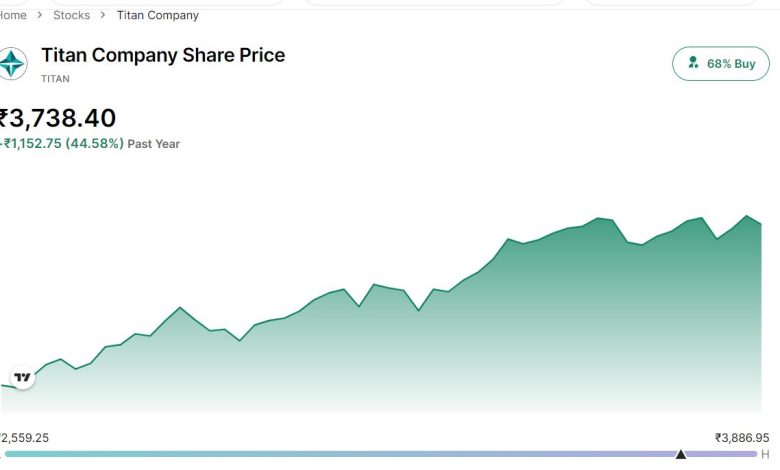

As investors look to capitalize on the future of steel and its applications in the consumer goods industry, investing in Titan share price emerges as a compelling option. By analyzing key factors influencing Titan’s future trajectory, including consumer demand, supply chain dynamics, innovation, and market expansion, investors can make informed investment decisions. Additionally, managing demat account how to open charges strategically is essential for maximizing investment returns and achieving long-term financial goals.