Exploring InsurTech Market: High Demand Segment, Geographical Share, and Investment Opportunity

The Global InsurTech Market: Size and Forecast to 2026, the Most Recent Report from Markntel Advisors

The Global InsurTech Market research report is one in a new line of in-depth studies from Markntel Advisors that offer crucial statistics on the market. These studies cover topics like market size, regional market shares, competitor analysis, in-depth market segmentation, emerging market trends, potential business opportunities, and any other pertinent information needed to succeed in the market.

How Big is the Global InsurTech Market?

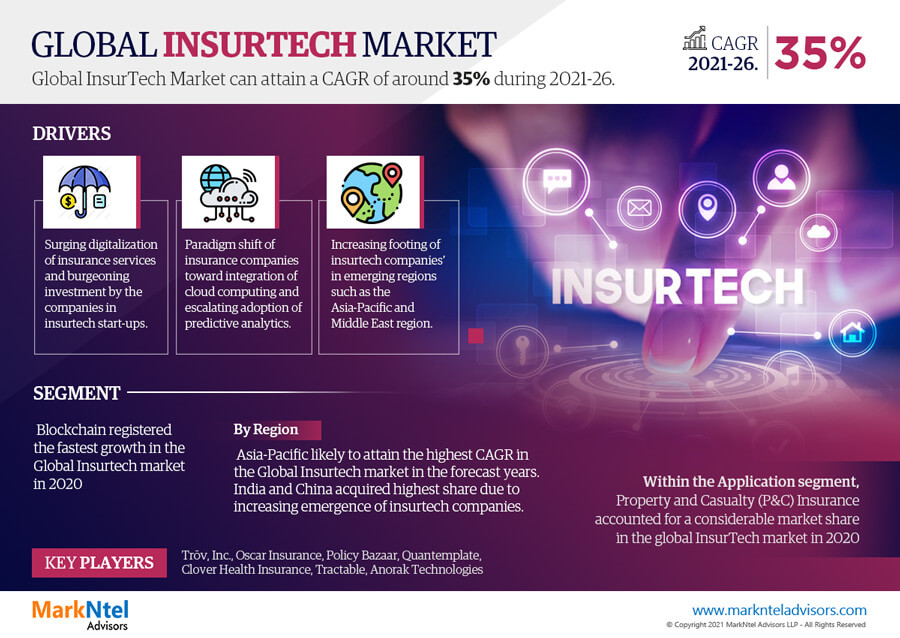

The Global InsurTech market size reflects its substantial presence in the industry, poised for consistent expansion. With a notable CAGR of around 35% during the forecast period 2021-26.

Which Key Factor Shaping the Growth of InsurTech Market?

Rapid Digitalization to Transform Business Models in the Insurance Sector – The rapidly changing business models, constant technological advancements in services & solutions, & increasing support from the governments of different countries promoting digital transformation in the insurance industry are propelling the demand for InsurTech solutions substantially & globally. It, in turn, is displaying an increasing adoption of these solutions among insurance companies to leverage their offerings & expand reachability across different regions worldwide, thereby driving the Global Insurtech Market in the coming years.

Investigating the Global InsurTech Market in High-Growth Segments and Regions/Countries

The study on the InsurTech market shows a sizable degree of segmentation, including several market categories and geographical areas. These distinct divisions provide insightful viewpoints into the opportunities and difficulties that shareholders face, illuminating shifts in InsurTech market size, sales, profits, volume, and pricing, among other crucial metrics—all of which are advantageous for prospective investors. Additionally, stakeholders can obtain a thorough picture of the outside variables that might affect the market’s growth path over time.

1. By Technology

- Block chain

- Cloud Computing

- Internet of Things (IoT)

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Drones

2. By Deployment Mode

- On-Premise

- Cloud

3. By Application

- Life and Accident Insurance

- Health and Medical Insurance

- P&C Insurance

- Commercial Insurance

- Insurance Administration and Risk Consulting

- Annuities

Geographically, the Global InsurTech Market extends across the following regions:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Access the InsurTech Market Free Sample PDF –https://www.marknteladvisors.com/query/request-sample/global-insurtech-market.html

Through 2026, Key Participants Will Shape the Global InsurTech Market Dynamics.

Global InsurTech Market dynamics and competitive forces play a pivotal role in determining the prominence of industry participants. As new technologies emerge, consumer preferences evolve, and economic conditions fluctuate, companies must adapt swiftly to maintain their position in the market. Consequently, the specific list of leading players may undergo shifts and transformations, reflecting the industry’s dynamic nature.

In the ever-evolving landscape of the Global InsurTech Market, many influential players, including:

- Trov, Inc.

- Oscar Insurance

- Policy Bazaar

- Quantemplate

- Clover Health Insurance

- Tractable

- Anorak Technologies

- Majesco

- Cytora Ltd.

- Zhongan Insurance

stand at the forefront, shaping the dynamics of the industry. These prominent companies continually vie for dominance, driving innovation and setting new trends that impact the market growth trajectory.

Our comprehensive InsurTech Market study report serves as a valuable resource, offering insights into the latest developments in the industry and identifying the current frontrunners. By analyzing market trends, growth opportunities, and competitive strategies, our analysts strive to empower businesses to make well-informed decisions in order to stay ahead of the competition.

Note – In case you forgot, we are now editing our reports. To obtain the most recent research information, including market size, industry trends, and competitive analysis, for the years 2023 to 2028, click on the button labelled “Request Customization.” The team would be able to deliver the most recent iteration of the report in a short period of time..

Other Key Questions Answered in the ‘Global InsurTech Market Analysis Report 2021-26

- What is the current InsurTech market size, and how is it expected to evolve in the coming years?

- Who are the leading companies operating in the InsurTech Market, and what strategies are they employing to maintain their competitive edge in the industry?

- What elements are restricting the InsurTech market growth during the anticipated period?

- What emerging trends are shaping the InsurTech Market size, share and growth landscape, and how are businesses adapting to capitalize on these trends?

- What areas or categories in the global InsurTech market during 2021-26 show promise for investments?

- What current technological developments and legal frameworks are affecting the global InsurTech market’s growth?

- How are the major industry rivals split up in terms of market share for InsurTech?

- What are the suggested entry points and tactical strategies into the global InsurTech market?

About us –

MarkNtel Advisors is a leading research, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

Using such information, our clients can identify attractive investment opportunities & strategize their moves to yield higher ROI (Return of Interest) through an early mover advantage with top-management approaches.

We understand the mounting & diverse needs of our clients. Hence, our analysts focus on emerging industries to provide services that fulfill their assessment of the current & future industry potential, identify white spaces & hotspots, & venture into new geographies or business segments in the future.

Contact Us –

Call 📞 +1 628 895 8081 +91 120 4278433

Email: 📧[email protected]